What is Uprise?

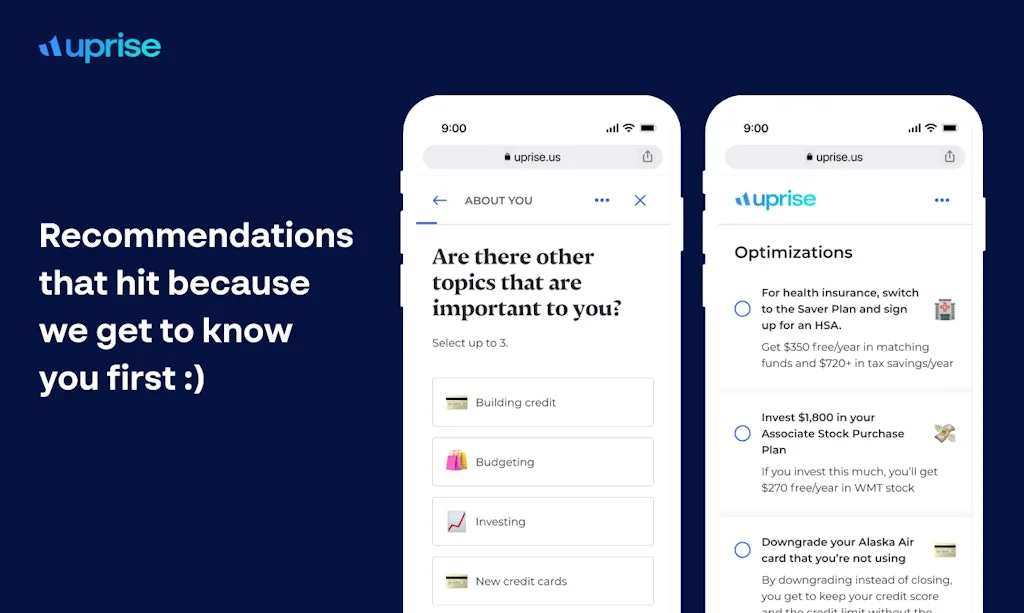

Uprise looks at your *whole* financial picture and tells you exactly what to do with your money: tax strategies, the best accounts, investment best practices, which benefits to use, etc. We've found an average $1.5M (!) in net worth per user so far.

Pros & Cons

Pros

- Personalized financial plans

- Actionable recommendations

- Budgeting features

- Investment guidance

- Beginner friendly

- Goal tracking

- Credit card recommendations

- Free tier

- Retirement account guidance

- Tax guidance

Cons

- No support for users with kids

- US only availability

Tool Details

| Categories | Tax preparation, Financial planning, Investing |

|---|---|

| Website | uprise.us |

| Became Popular | May 26, 2022 |

| Platforms | Web |

| Social | Twitter · Instagram |

Recent Reviews (6)

Uprise is just getting started!

Uprise was extremely beneficial in helping me visualize my financial goals. As it continues to grow and features are added, I 100% expect it to be my main tool for personal finance, replacing a combo of various budgeting and net worth tracking apps. I feel heard and listened to as a user, and the customized plans are something I’d never expect to be given access to without the slog of meeting with several advisors who I feel are not acting in my best interest. With uprise, I’m able to get a plan and great advice with a service I trust with no hassle. And I can always check in and see how I’m doing without having to contact someone and set up an appointment!!

Love the product! Working in finance, I'd like to think that I have an idea of how to manage my personal finances, but this really opened my eyes to some key considerations I just didn't consider. From mapping out my financial goals over the next 10 years to creating a personalized actionable plan I could implement today, Uprise really helped me make some personal finance decisions involving my 401(k), investment accounts -- even credit cards. Not to mention that it was all free!

Uprise truly lives to its mission and truly helps people - especially those who’ve never had any experience planning for the future. No one talks about Finance! It’s an uncomfortable situation. My friends and even my family don’t talk about it either. I’ve never made a budget before Uprise! With each change in my life from starting my new career to even investing/health care, Uprise has been there for it all. Truly worth anyone giving it a shot!

Uprise helped me create a financial plan as I got my first job out of college and gave me the confidence to budget, manage my finances, and save for the future!

Huge supporter of this team and the mission! I tried it out, switched savings accounts, and made some major changes to how I save vs. spend!

Frequently Asked Questions about Uprise

When did Uprise become popular?

Uprise became popular around May 26, 2022.

What are the main advantages of using Uprise?

The top advantages of Uprise include: personalized financial plans, actionable recommendations, budgeting features, investment guidance, beginner friendly.

What are the disadvantages of Uprise?

Some reported disadvantages of Uprise include: no support for users with kids, US only availability.

What is Uprise's overall user rating?

Uprise has an overall rating of 5.0/5 based on 6 user reviews.

What type of tool is Uprise?

Uprise belongs to the following categories: Tax preparation, Financial planning, Investing.

Related Tax preparation Tools

Related Financial planning Tools

Related Investing Tools

Compare Uprise :

Don't Get Fooled by Fake Social Media Videos

The world's first fact checker for social media. Paste any link and get an instant credibility score with sources.

Try FactCheckTool Free