What is Mayfair?

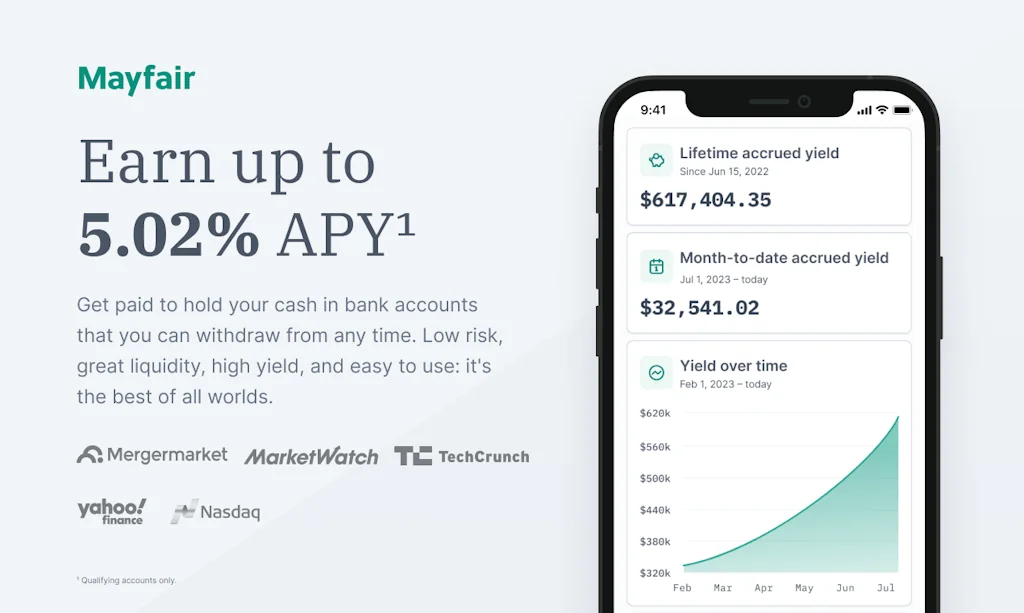

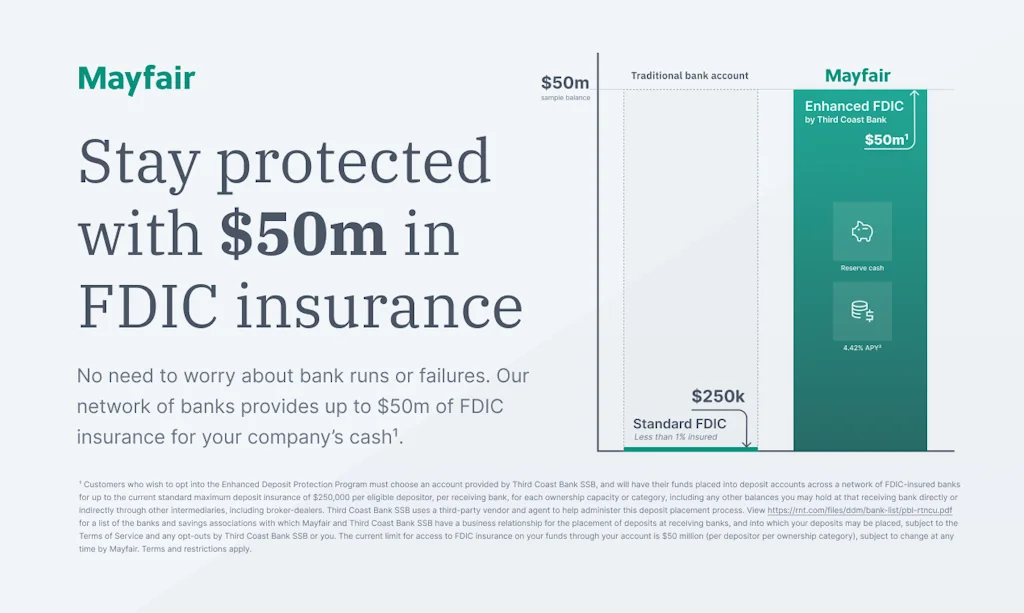

Mayfair is the high-yield cash account that earns you 5.02% APY on your business's cash while protecting it with up to $50m in enhanced FDIC insurance . It takes less than 10 minutes to set up, integrates with your existing bank, and has unlimited free transfers.

Pros & Cons

Pros

- High APY

- Quick account setup

- 1-day ACH transfers

- Responsive customer service

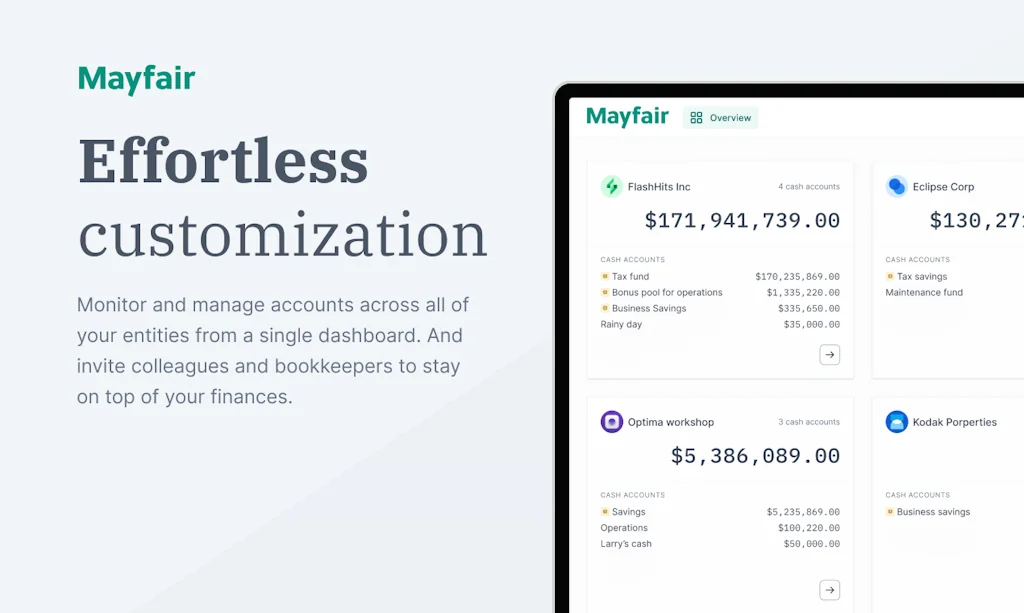

- Simple cash management

- Competitive rates

- User-friendly interface

- Detailed reports

- Enhanced FDIC insurance

- Fast onboarding process

- Integrates with existing bank

- Transparent rates

Cons

- Slow customer support

- Limited FDIC coverage

- US only

Tool Details

| Categories | Online banking, Neobanks, Money transfer |

|---|---|

| Website | www.getmayfair.com |

| Became Popular | November 29, 2022 |

| Platforms | Web |

| Social |

Recent Reviews (9)

Spent most of September looking for ways to leverage high interest rates for my business. Heard about Mayfair on Twist, seemed like a good fit and has been satisfactory so far.

Customer support is a bit slow at times but I understand they're still new

Congratulations on the launch - it's a fantastic concept! Any plans to open this up for UK business accounts anytime soon?

I use Mayfair as a "simple cash management" tool for multiple clients. The rates are competitive, the team is responsive (they also listen to my ideas to improve the product), and the enhanced FDIC insurance is a game changer. Smart cash management (using Mayfair) is increasing my clients profit margins by about 1.5%. It's a win-win.

Kent and the team at Mayfair offer a great product! Easy setup using plaid to connect stripe and my business account, I get to (Safely!) earn cash on my income tax money that would ordinarily sit in a savings account until April. Very pleased! Highly recommended! Thanks Mayfair.... Kent for president of the USA!!

Have enjoyed the experience using Mayfair! Fantastic product with low touch, easy to set up, and makes us money each week with rates that are much better than what we could find elsewhere.

The 4% APY is better than anywhere else--and the instant access to funds has been a lifesaver when we had a chance to renew core infrastructure contracts at a steep discount EOY

Have had a great experience with Mayfair thus far. Very smooth onboarding process and helpful staff. Has the recipe for being an excellent product!

Awesome product.. Keep Going

Frequently Asked Questions about Mayfair

When did Mayfair become popular?

Mayfair became popular around November 29, 2022.

What are the main advantages of using Mayfair?

The top advantages of Mayfair include: high APY, quick account setup, 1-day ACH transfers, responsive customer service, simple cash management.

What are the disadvantages of Mayfair?

Some reported disadvantages of Mayfair include: slow customer support, limited FDIC coverage, US only.

What is Mayfair's overall user rating?

Mayfair has an overall rating of 4.9/5 based on 10 user reviews.

What type of tool is Mayfair?

Mayfair belongs to the following categories: Online banking, Neobanks, Money transfer.

Related Online banking Tools

Related Neobanks Tools

Related Money transfer Tools

Compare Mayfair :

Don't Get Fooled by Fake Social Media Videos

The world's first fact checker for social media. Paste any link and get an instant credibility score with sources.

Try FactCheckTool Free