Reap Pay

Business payments in your preferred currencies

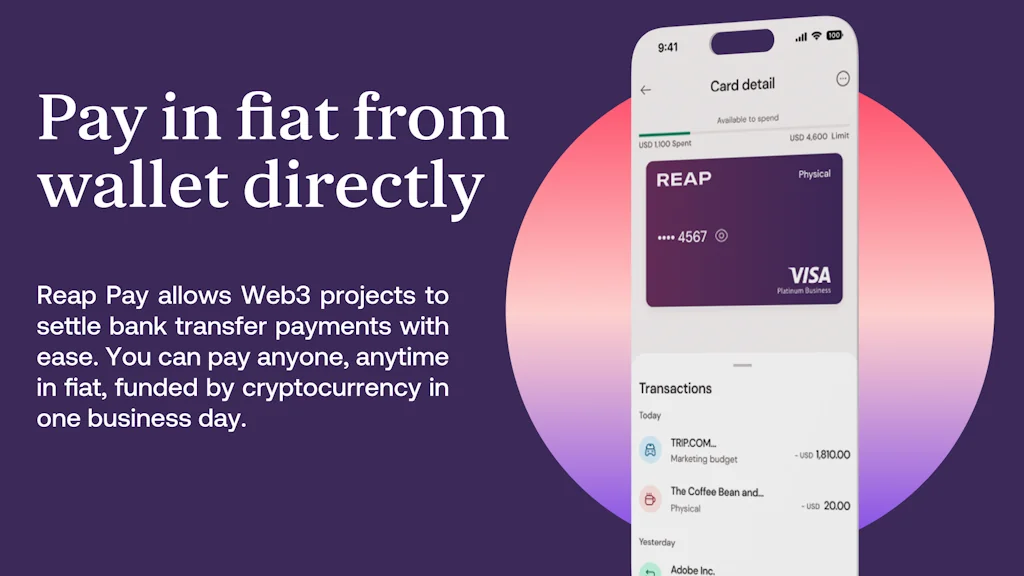

What is Reap Pay?

Fund international or local bank transfers using credit cards or stablecoins with Reap. Unlock a world of payment possibilities and enjoy our extensive global reach.

Pros & Cons

Pros

- Credit card payments

- Crypto payments

- Automated payment schedules

- Fast performance

- Employee credit cards

- Integration with Xero

- Multiple currency support

- Payment link invoicing

- Recurring payments

Cons

- Trustworthiness concerns

- Customer service issues

- Unauthorized transactions

Tool Details

| Categories | Online banking, Payment processors, Money transfer |

|---|---|

| Website | reap.global |

| Became Popular | April 3, 2023 |

| Platforms | Web |

| Social | Twitter · LinkedIn |

Recent Reviews (3)

We have used REAP for 3-4 years for multiple startups ranging between 2 to 100 people. Depending on the scale there is great value you can get, which traditional credit card or finance services can't always offer. - Create credit cards for employees, server payments, subscriptions, uber, snacks or anything with few clicks - Output back all data to xero in few clicks and then automatic - Make repayment by regular bank transfer or alternative method, or autopay in some cases. - Issue invoices to customers with payment link to collect payment. Which is normal, but you can send link and customer puts amount they want. For example for startup that provides service but is uncertain about price to charge the customer. - Pay vendors in one of major currencies and settle back by common crypto like Binance, BTC, ETH, USDT etc. - Well, we also used to pay rent or salary or extend a cashflow There should be also many more ways to use REAP, curious to see other company experiences

I appreciate the variety of payment options offered, including card payments, ACH, and eChecks, which will undoubtedly help businesses reach a broader range of customers. The ability to automate payment schedules and set up recurring payments is also a great feature that will save businesses time and resources. Congratulations on the launch, and I wish you all the best in your future updates and growth!

Reap solved our main pain point when paying suppliers by providing as a very functional credit card, perfect for crypto-native businesses.

Frequently Asked Questions about Reap Pay

When did Reap Pay become popular?

Reap Pay became popular around April 3, 2023.

What are the main advantages of using Reap Pay?

The top advantages of Reap Pay include: credit card payments, crypto payments, automated payment schedules, fast performance, employee credit cards.

What are the disadvantages of Reap Pay?

Some reported disadvantages of Reap Pay include: trustworthiness concerns, customer service issues, unauthorized transactions.

What is Reap Pay's overall user rating?

Reap Pay has an overall rating of 5.0/5 based on 3 user reviews.

What type of tool is Reap Pay?

Reap Pay belongs to the following categories: Online banking, Payment processors, Money transfer.

Related Online banking Tools

Related Payment processors Tools

Related Money transfer Tools

Compare Reap Pay :

Don't Get Fooled by Fake Social Media Videos

The world's first fact checker for social media. Paste any link and get an instant credibility score with sources.

Try FactCheckTool Free