What is bunq?

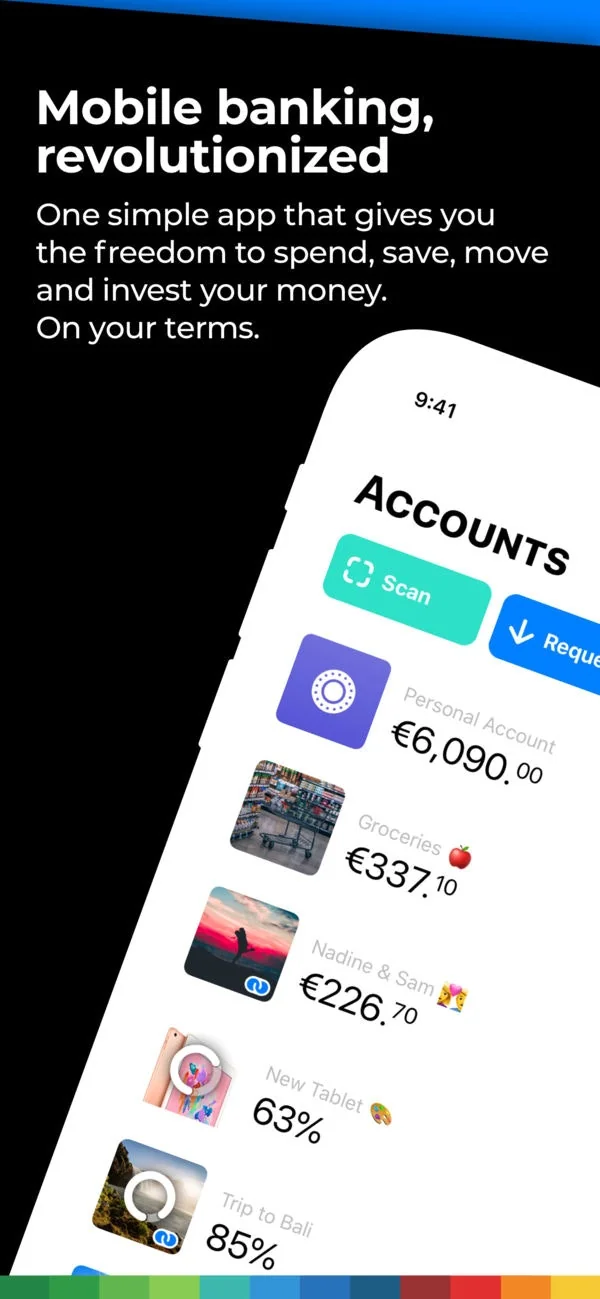

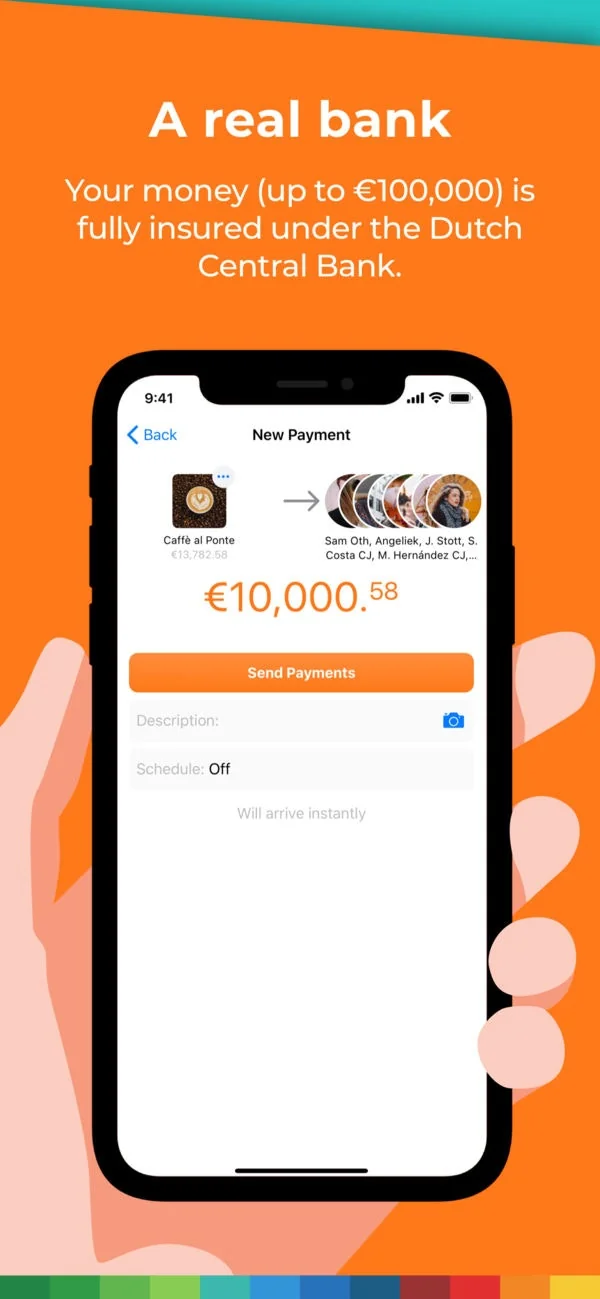

We are bunq, Bank of The Free. We’re here to break free from the status quo, and create a bank with our users in mind. Giving them the freedom to live life on their own terms.

We built our own financial system from the ground up, and with the launch of our app in 2015, reinvented banking as you know it. And that’s just the beginning!

Pros & Cons

Pros

- Easy account management

- Affordable pricing

- ATM fee waivers

- Beginner-friendly

- Budgeting tools

- Cashback offers

- Easy setup

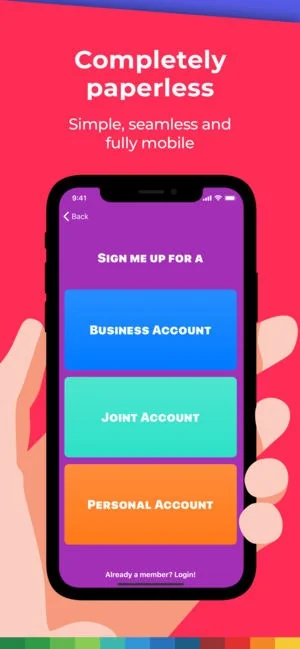

- Fast registration

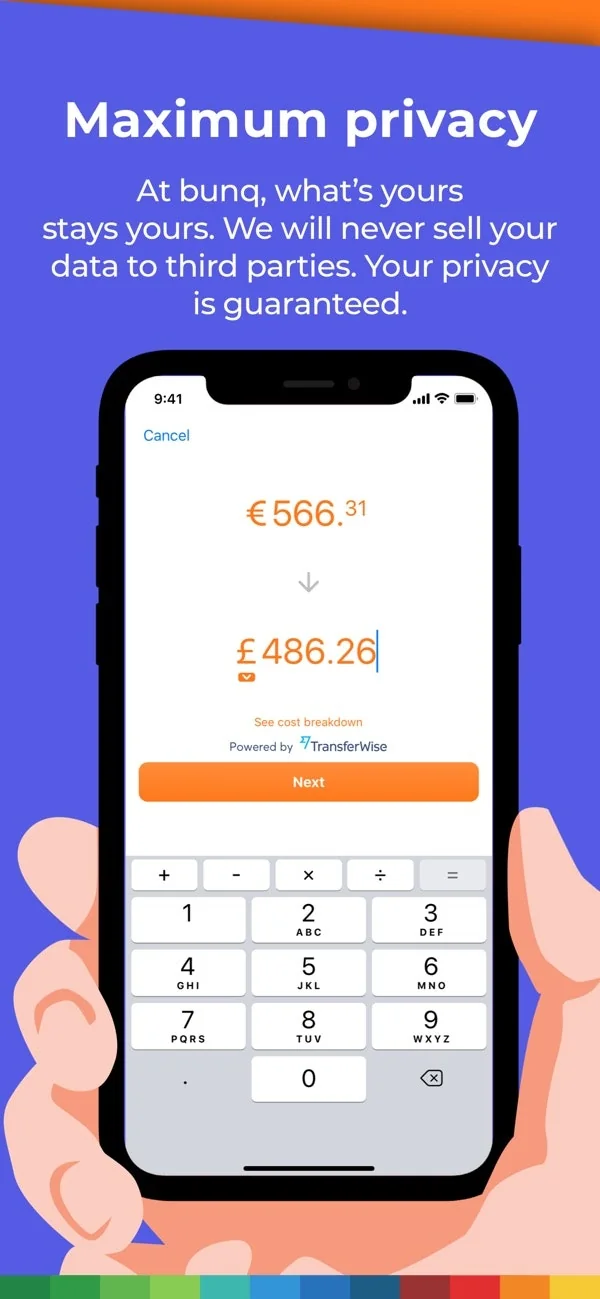

- Free foreign currency transfers

- Free trial

- High interest savings

- Joint accounts

Cons

- Excessive fees

Tool Details

| Categories | Neobanks |

|---|---|

| Website | www.bunq.com |

| Became Popular | March 10, 2017 |

| Platforms | Web · iOS · Android |

| Social | Twitter · Instagram · GitHub |

Recent Reviews (10)

Among all subscriptions that are available in Bunq, here are those that offer basic services to customers and those that offer more advanced ones. Advanced ones include Easy Bank, Easy Bank Pro and Easy Bank Pro XL subscriptions. Each of these subscriptions has a different cost. And the most profitable option is Easy Bank ;) This subscription is the cheapest, but it also has access to some useful features. Of course, unlike Pro and Pro XL subscriptions, this one has some drawbacks. For example, I have only one virtual credit card. But other than that, I like this subscription =)

Using Bunq was the best decision I could have made for my finances. The bank provides a lot of tools that can be enjoyed across all account types, but I most especially appreciate the budgetting tools, the AI assistant, the interest on savings, and the automation that the bank provides on payments. 😎 The application is also very user-friendly and easy to operate and whenever I need assistance the customer service team is quite fast. I will be here for A LONG PERIOD OF TIME!

I’m not sure how the AI bot work for others, but it is a bit laggy and gives an off topic information. The idea is good, but the performance is not the best. Besides the bot, as a bank they are solid. To get the best of them it is essential to have a pro subscription at least, as it opens a tons of new features. For instance, the couple of foreign transactions are free as well as atm withdrawals.

I wanted to share my feedback about Bunq. Earlier in my life, I always went to a bank branch and stood in line for a few hours to open a bank account. Recently, I came across the Bunq accidentally and saw that they allow customers to open a bank account online and quickly. Well, I was surprised and I actually opened a bank account in 5 minutes and online. Thank you for such quality of service!!!

I've used Bunq for a while, and while it’s a solid digital bank, it’s not perfect. The app is smooth, and transactions are fast, but fees can feel excessive. Customer support has been hit or miss in my findings. It’s great for convenience, but some limitations, like account restrictions, make me question if it's truly the best option.

I got sick of living from hand to mouth and I couldn't get what I’ve been doing wrong all that time. I wasn't a financially stable person but the situation changed when one of my old friends recommended the bunq. He spoke highly about them and shared his experience of cooperating with this bank. Well, I got interested in that also and it turned out they have so many budget features which helped me to manage my funds more properly. I wouldn’t say I became more stable in terms of finances but at least I learned how to save money about 20% of my salary every month. I’m still learning the ropes.

I have seen some people say that they do not like finn, the AI assistant, but I think that it is quite exciting to have the AI on the platform, be it in the beta phase. For one, it reduces the number of irrelevant questions that the support team is asked. It is quite accurate too. Finn aside, I really enjoy using the bank, and I think it is very helpful to students like myself. We were never taught things like money management and budgeting, and it is cool to have a bank provide easy tools to help with all of that.;-)

App works great. Every update something slightly breaks though. Sometimes its a visual bug, sometimes there's screen glitching, happened ones. But for how many features it has, I still like it.

I use this for "high yield" . Default money account, not even doing anything. Still earning more than most banks could give me. For real though, I think bunq and other "neobanks" are straigh-up better . I see so many extra features here that Credit union and others just dont even think of. And if something else users wants appears - I see it on forums, and in 3-5 months I see it in the app.

Frequently Asked Questions about bunq

When did bunq become popular?

bunq became popular around March 10, 2017.

What are the main advantages of using bunq?

The top advantages of bunq include: easy account management, affordable pricing, ATM fee waivers, beginner-friendly, budgeting tools.

What are the disadvantages of bunq?

Some reported disadvantages of bunq include: excessive fees.

What is bunq's overall user rating?

bunq has an overall rating of 4.5/5 based on 41 user reviews.

Is bunq available on mobile devices?

Yes, bunq is available on iOS (App Store) & Android (Google Play).

What type of tool is bunq?

bunq belongs to the following categories: Neobanks.

Related Neobanks Tools

Compare bunq :

Don't Get Fooled by Fake Social Media Videos

The world's first fact checker for social media. Paste any link and get an instant credibility score with sources.

Try FactCheckTool Free