Arc

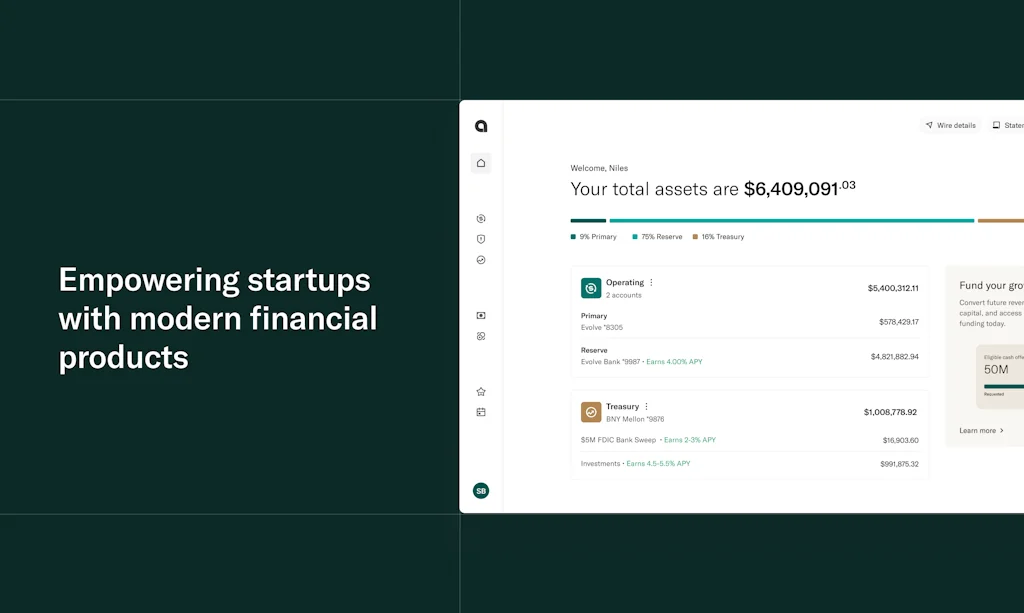

Software-driven banking & growth capital for startups

What is Arc?

Arc empowers startups with a better banking experience. With Arc, you can open FDIC-insurance eligible accounts in minutes, manage everyday banking needs without fees, diversify & safeguard cash, maximize yield, and instantly access growth capital—all in one platform and partnering with trusted banks. Based in SF & NYC, Arc has raised $180M+ of equity and debt funding from Left Lane, NFX, BCV, YC, among others. [Arc is a technology company, not a bank: arc.tech/general-disclosures]

Pros & Cons

Pros

- Excellent customer support

- Comprehensive startup banking

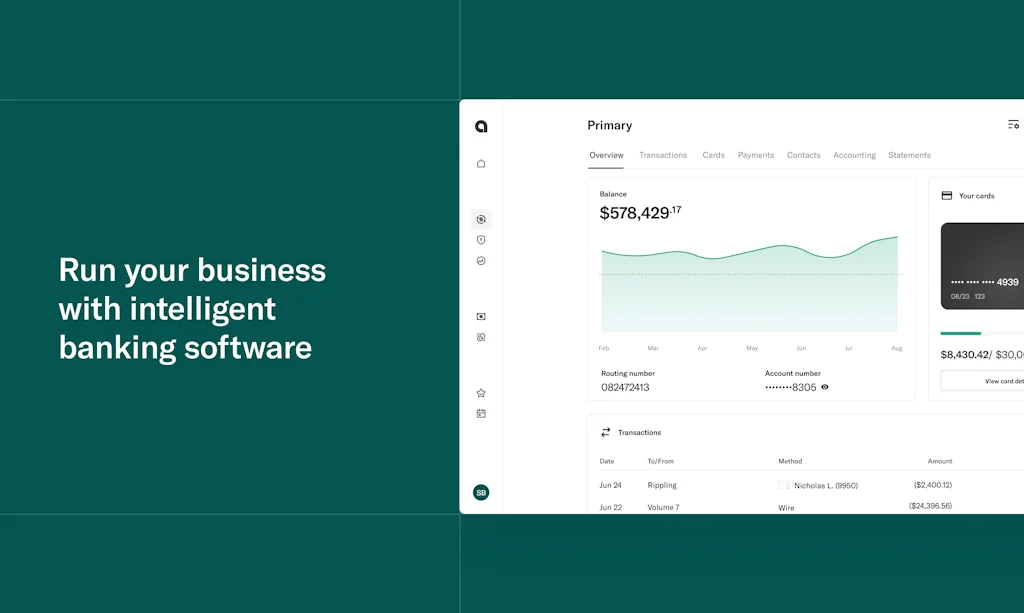

- Modern UX/UI

- Responsive team

- Fast account setup

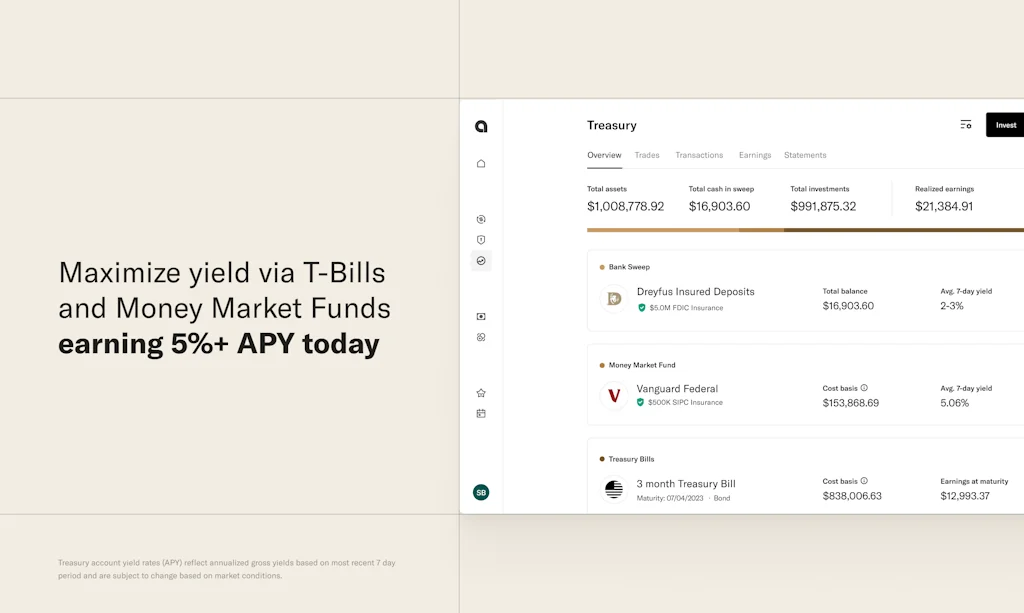

- High yield savings

- Secure platform

- Software-driven banking

- Efficient cash management

- Fast product development

- Tech-centric platform

- Growth capital access

- Community trust

- High interest rates

- Integrated financial products

- No equity requirement

- Transparent process

Cons

- Billing issues

Tool Details

| Categories | Online banking, Financial planning, Neobanks, Treasury management platforms |

|---|---|

| Website | www.arc.tech |

| Became Popular | June 29, 2023 |

| Platforms | Web |

| Social | Twitter · Instagram · LinkedIn |

Recent Reviews (9)

Arc has become widely used and well-regarded in the YC Community, which has high standards for products like this. Many YC companies tell us they love Arc and have had a great experience. In the wake of the SVB & FRB collapses earlier this year, the startup world desperately needs high quality banking products designed for tech companies. Arc elegantly solves the issue of FDIC limits to ensure that your money can't ever be vulnerable to a bank run, while also bundling all the modern features you would expect from a banking product.

We recently became customers of Arc at Momentum, but have been following their progress for the last 9 months or so. The speed at which they've been able to ship a full suite of products for startups like us is nothing short of impressive. When we were looking to switch from a more traditional bank in favor of a platform that's wayyy more tech-first, Arc was a no-brainer to go with. Not to mention - the team and customer support is awesome! Can't wait to see what else they come up with. Congrats, Arc!

HUGE fan of Arc, they have made everything so simple that we have basically automated all of our startup banking needs. It also doesn't hurt that we get 5%+ APY on our savings in the account. 10/10 I recommend them to anyone who needs a tech-centric option for their bank.

Arc has been a superior banking experience for my company compared to traditional banks. We get far better customer service, higher interest rates and a better platform to leverage to maximize the cash that we have in our bank which has led us to hiring additional staff to grow our company.

I've been an Arc banking customer for over a year now and am amazed at how much more seamless and efficient Arc banking is relative to other traditional banks I've used in the past. Their product velocity and high-touch customer service have been unmatched for me - Arc has really thought of every detail when it comes to building the best platform for its customers, and the focus on delivering best-in-class really shines through.

The Arc team has executed at incredible speed over the last two years and built products that founders truly love. I've been impressed with how quickly they shipped badly needed products in the wake of SVB falling. Don, Nick, Raven and team are always putting the customer first, not something to be taken for granted in fintechs today. Congrats Arc on your PH launch!

Wow, this looks really easy to use. Super sleek design with clear calls to action. I once setup an SVB account and had no idea what was going on with their confusing UI and finance jargon. It looks like Arc really understands where tech founders are coming from, and they're building a great experience for them!

We've been using Arc, and managed to put 70% of our capital to use generating more revenue. Thanks to Arc, our 5-person company can offset the cost of an entire engineer this year. Thanks Arc!

Arc is absolutely a fantastic product. We've used the product successfully at g2i.co and had a great experience. The process is transparent and you don't have to give away equity.

Frequently Asked Questions about Arc

When did Arc become popular?

Arc became popular around June 29, 2023.

What are the main advantages of using Arc?

The top advantages of Arc include: excellent customer support, comprehensive startup banking, modern UX/UI, responsive team, fast account setup.

What are the disadvantages of Arc?

Some reported disadvantages of Arc include: billing issues.

What is Arc's overall user rating?

Arc has an overall rating of 4.9/5 based on 20 user reviews.

What type of tool is Arc?

Arc belongs to the following categories: Online banking, Financial planning, Neobanks, Treasury management platforms.

Related Online banking Tools

Related Financial planning Tools

Related Neobanks Tools

Related Treasury management platforms Tools

Compare Arc :

Don't Get Fooled by Fake Social Media Videos

The world's first fact checker for social media. Paste any link and get an instant credibility score with sources.

Try FactCheckTool Free